Is Apple on Target for Continued Growth This Current Year

Shahid Jamil

This article was prepared by Navyanshi Nayan in collaboration with Dilantha De Silva.

Apple Inc. (NASDAQ:AAPL) shares have fallen 23% this year due to concerns about deteriorating macroeconomic conditions. Apple is best known for its iconic iPhones, and the release of new models causes a buying frenzy in stores worldwide every year as the company rarely fails to delight customers with improved design and functionality. However, as the iPhone business matures, investors are wondering what the next big growth driver will be for the tech giant and whether the recent drop in Apple stock presents an opportunity to invest in the company at a bargain price.

What Are Apple Catalysts To Watch For?

On September 7, Apple released its third-generation 5G smartphones; the iPhone 14 series, Apple Watch Series 8, and the second-generation AirPods Pro wireless earbuds. The launch of these new devices momentarily boosted the stock in after-hours trading, but the enthusiasm did not last long. Analysts are concerned that premium product sales will not meet the target in the current economic climate. Analysts also predict that Apple will hold a second launch event this month to announce new iPad tablets and Mac computers. However, Mark Gurman, a Bloomberg tech reporter with a long track record of accurate reporting on Apple's product plans, believes the company will announce the remaining products via press release rather than at an event.

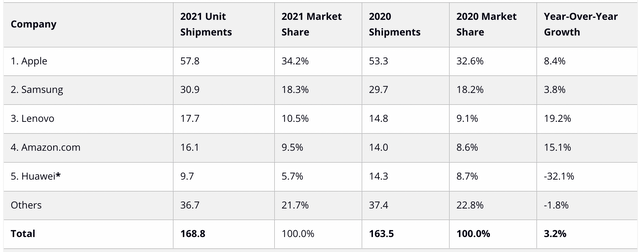

With the work-from-home trend boosting the demand for tablets since 2020, Apple and many other electronic device manufacturers enjoyed stellar growth in tablet shipments last year, which makes the launch of new iPad devices a catalyst to look out for.

Exhibit 1: Worldwide tablet shipments (2021)

IDC

Source: IDC

In June, the company unveiled a new M2 chipset for the MacBook Air and 13-inch MacBook Pro. That means there will be no major updates or design changes to the Macs and iPads. Because Apple has already released its most anticipated and primary product, the iPhone, and the other devices are expected to have no major changes, Gurman believes it makes sense for Apple to announce the release of remaining products "via press releases, updates to its website, and briefings with select members of the press." These launches, regardless of how Apple chooses to announce them, will be important drivers of AAPL stock in the short run.

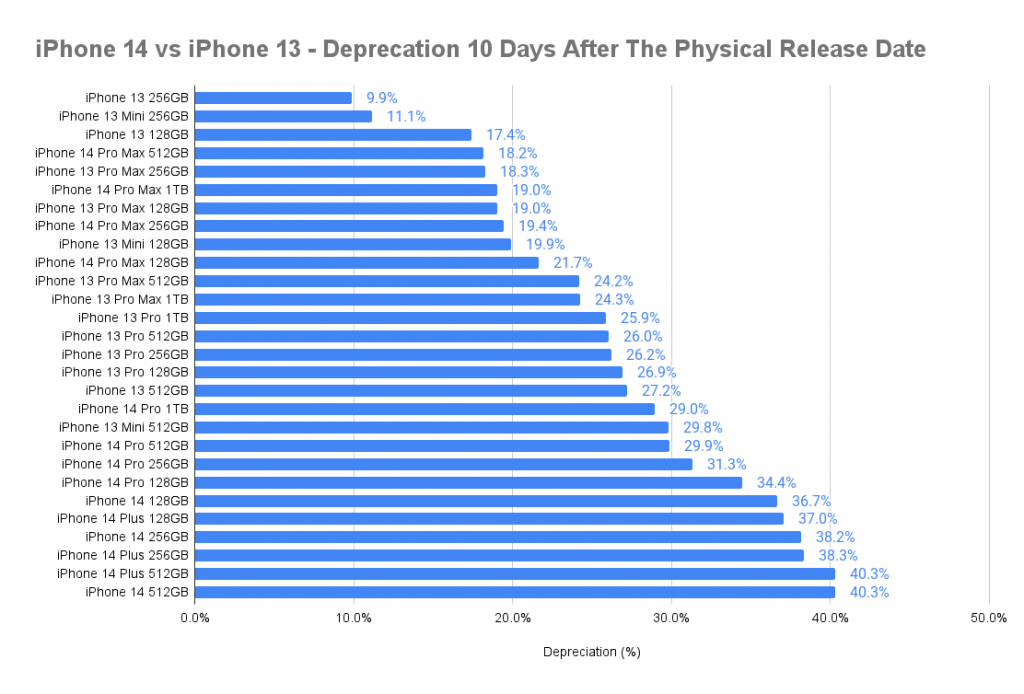

Unfortunately for investors, the products themselves aren't particularly exciting upgrades, which means that sales are unlikely to take off as one would have expected in this quarter. The new iPhone model was even trolled on social media for having features similar to the previous model but at a higher price. According to Bloomberg, Apple is holding off on plans to ramp up production of its new iPhones this year due to a drop in demand. The company has asked its suppliers to scale back plans to increase the assembly of the iPhone 14 product family by up to six million units over the second half of the year; however, the plans have not been made public. According to the report, Apple now expects to manufacture approximately 90 million handsets during the period, roughly the same as last year. Given that the iPhone is currently Apple's flagship product accounting for approximately 53% of sales so far this year, a continued decline in the demand for iPhone devices could push Apple stock down in the foreseeable future. According to SellCell, iPhone 14 family devices have depreciated at close to double the rate iPhone 13 devices did in the first 10 days since launch. This is not an encouraging sign.

Exhibit 2: iPhone 14 vs iPhone 13 - depreciation 10 days since launch

SellCell

Source: SellCell

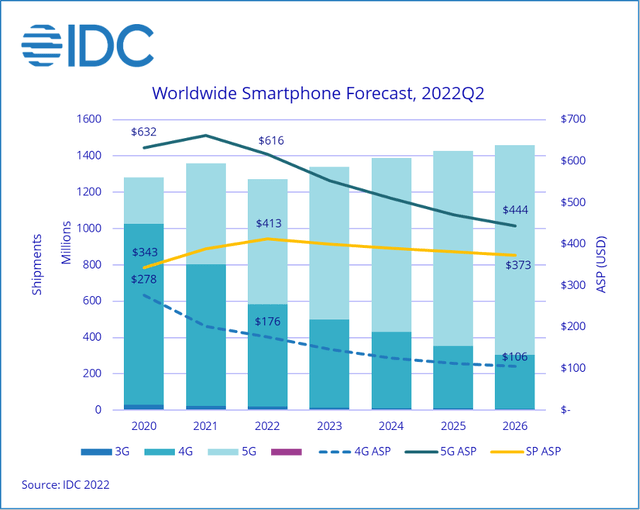

Some analysts believe that the challenging economic environment in Europe because of the Ukraine war, and in China because of new COVID-19 waves this year, have resulted in weak demand. This trend may have an impact on overall iPhone sales in fiscal 2023. In China, purchases of the iPhone 14 series during its first three days of availability were 11% lower than its predecessor the previous year. According to IDC, the smartphone market will contract by 6.5% this year to 1.27 billion units as rising inflation, recession fears, and geopolitical tensions continue to dampen global consumer demand for personal electronic devices.

Exhibit 3: Worldwide smartphone shipment forecast (June 2022)

IDC

Source: IDC

In the United States, the iPhone still commands approximately half of the market. Even if sales appear sloppy, Apple's future is far from bleak. The iPhone is a "sticky product," according to Warren Buffett, one of Apple's largest shareholders. Because of Apple's ecosystem, which allows customers to use a variety of add-on services securely and conveniently, switching to a competitor is expensive. This means that, even as personal electronic sales slow, Apple can benefit from its services, which boosted Apple's sales and profits in the most recent quarter. There is also speculation that Apple will launch a Virtual Reality and Augmented Reality headset in January, with analysts anticipating the launch as a major driver of Apple stock.

In the long run, the major catalyst for Apple stock would be the performance of Apple's services segment which is growing faster than hardware sales. If Apple can continue to expand the number of active Apple devices in use, even at a slow pace, the company will still be able to secure double-digit earnings growth by focusing on promoting its services.

Is Apple Expected To Grow?

Apple shares have taken a hit this year as technology stocks in general have been punished because of interest rate hikes and macroeconomic uncertainty. Apple saw a sharp sell-off following reports that demand for the latest iPhone 14 handsets was lower than expected. This year, there is a wider gap between Apple iPhone Pro and base models, and this higher price tag may have resulted in a decline in the demand for iPhone 14 Pro and Pro Max. This is likely to lead to a slowdown in revenue growth.

Due to supply chain issues, Apple's other product categories which include Apple's Wearables, Home, and Accessories unit, saw sales fall 8% to $8.08 billion in the fiscal third quarter. The Services segment grew the fastest, with revenue increasing 12% YoY to $19.6 billion. The services segment includes the App Store, AppleCare, iCloud, Apple Pay, Apple Music, Apple TV+, Apple Arcade, and other offerings. Apple generated $366 billion in annual sales in 2021 with the product segment accounting for 81% and the services segment accounting for 19%. In the June quarter, its products segment contribution fell 0.9% YoY, accounting for 76% of total revenue while the services segment accounted for 24% of revenue.

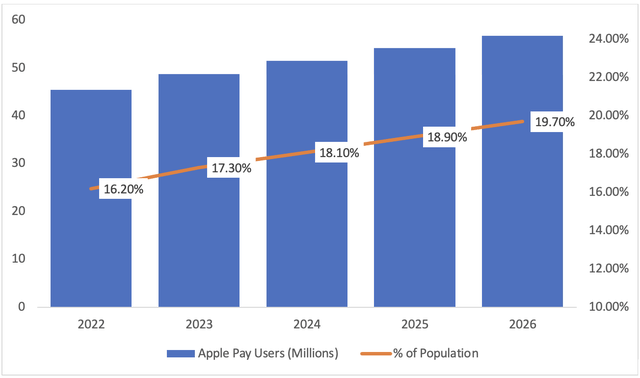

Apple's services business has room to expand and can become a larger part of the overall business. Apple Pay, for example, has surpassed Mastercard in transaction volume over the last year as an increasing number of iPhone customers activate Apple Pay. According to eMarketer, the number of U.S. Apple Pay users is expected to reach 45.4 million in 2022, an increase of 8.7% YoY as one in every six American consumers uses Apple Pay at least once a month. The number of Apple Pay users is expected to rise to 54.2 million in 2025, and by 2026, there will be 56.7 million U.S. Apple Pay users according to eMarketer. Apple Pay is the most popular payment wallet service among Gen Z consumers due to its security features as well, which is another positive as Gen Z consumers will eventually take a larger share of the consumption pie in the long run.

Exhibit 4: U.S. Apple Pay Users and Penetration (2022-2026)

eMarketer

Source: eMarketer

Digital and wallet payments are gradually becoming more popular in other countries, implying that Apple Pay has a long runway for growth internationally.

As a company, the bulk of Apple's growth in the coming years is likely to come from the services segment. This is a positive development as the success of the services segment will create a reliable recurring revenue stream for the company. That being said, this transitory phase in which the services segment takes over the products segment will bring new challenges for the company and its shareholders, which is why we, at Leads From Gurus, decided to part ways with Apple late last year.

Where Will Apple Stock Be In 5 Years?

Apple has come a long way since the release of the first iPhone. However, the world is undergoing major technological changes today, prompting Apple to make radical changes to its business model to remain relevant. The Apple ecosystem is the one big advantage the company enjoys which enables Apple to smoothly transition to a services-oriented tech giant.

Apple is likely to maintain its market position in the long run but its business will evolve in the coming years to adapt to new market developments. Looking at the financial numbers and current market trends, it's clear that Apple's future growth is dependent on the services category, which appears to be highly profitable and rapidly growing. In Q3, the gross profit margin for the products segment fell 152 basis points YoY to 34.5% while the gross profit margin for the services segment increased 169 basis points to 71.5%. Investors should therefore pay close attention to how the services sector performs as it will have a significant impact on Apple's long-term success.

The growth of smartphones and tablets seen in the last decade is unlikely to be repeated in the next five years, but there is arguably a much larger market for Apple services. America, Europe, and the United States are the company's dominant markets today but Apple has significant room for growth in the Indian market as the economy welcomes domestic production of international products. JP Morgan analysts predict that by the end of 2022, Apple will shift 5% of the world's iPhone 14 production to India and increase its manufacturing capacity in the country to 25% by 2025. According to market research and analyst firm Techarc, the iPhone will sell slightly more than seven million smartphone units in India by the end of 2022. Despite India being a very competitive market for smartphone manufacturers, Apple could achieve a higher penetration once local production starts. The price of iPhones is one of the reasons why they are not widely adopted in India. Apple products are considered premium and are treated as such, but market experts believe that manufacturing locally will reduce the price burden on Indian consumers. Market share gains in India, which is quickly becoming the primary target market for tech companies of every size and scale, are likely to reflect positively on AAPL stock price.

Apple intends to launch hardware subscription services that will allow customers to purchase iPhones and other products for a monthly fee. According to Mark Gurman's newsletter, this service could be available later this year or in 2023. This will not only support demand but will also benefit the company in terms of recurring revenue.

Apple is facing challenges but the company still has room to grow. Earnings growth should support higher stock prices but Apple, in our opinion, is not cheaply valued today. Apple stock, therefore, is likely to offer modest returns in the next five years as opposed to the stellar returns seen in the last five years.

Takeaway

Apple still has room to grow but the going will not be as easy as it was in the last decade. The company is entering new markets and experimenting with its services segment, and the company is trying to set the tone for long-term, sustainable earnings growth. In our opinion, this mission will take at least five years, and therefore, we believe Apple is entering a business phase where the company will focus more on building a foundation for growth from which it may benefit in the very long run (10-15 years).

The unexpected moment is always sweeter

At Leads From Gurus, we strive to achieve sweet returns by predicting which companies would report unexpected earnings. Join us to discover the power of earnings surprises.

Your subscription includes access to:

- Weekly actionable ideas that would help you beat the market.

- In-depth research reports on stocks that are well-positioned to beat earnings estimates.

- Three m odel portfolios designed to help you beat the market.

- Educational articles discussing the strategies followed by gurus.

- Anactive community of like-minded investors to share your findings.

Act now to secure the launch discount!

colbournewenbestaide.blogspot.com

Source: https://seekingalpha.com/article/4545924-apple-stock-in-5-years

0 Response to "Is Apple on Target for Continued Growth This Current Year"

Post a Comment